Developing Children's Literacy: Family Reading Project Day 3

On day 3, Alula was reading books about object presence, Mama still continue to read the parenting book, and Papa is reading a book about investment.

Alula's Read

Title: Peek-a-boo

Author: Khalina Khalili

Summary:

The book highlights the concept of existence - the presence of something as opposed to nothing. This book is an introduction to the concept of Tawhid (the Oneness of Allah). Human beings need to be aware that Allah is exist.

Alula's response:

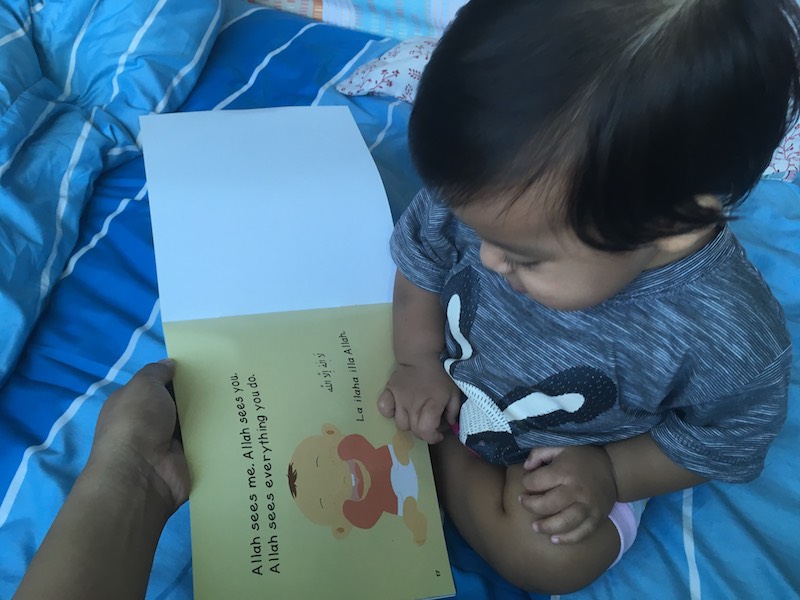

Alula loves to play peek-a-boo. On her earlier age, she always giggles whenever Papa or Mama plays peek-a-boo with her. Recently, she begins to be able to do the peek-a-boo by herself, closing her eyes with both of her hands and open them while saying "baa!" (boo in Bahasa). So, when I read this book to her, she pays attention and listens to my words as I read the lines. When it turns to open the pages, she did it carefully. To note, this book comes with thin paper pages, not a board books like she used to read. To my surprise, she handled it softly.

On every section of peek-a-boo, the author put the sentence La ilaha illa Allah to introduce the concept of Tawhid. Whenever I say that sentence, Alula tries to mimic me by mumbling, hehe..

Mama's Read

Title: Achtung Baby

Author: Sara Zaske

Chapter read: Chapter 3 (Attachment Problems)

Main Takeaway:

Parents need to set up a gentle boundaries with their children, in order for them to be independent. As important as we don't wake a sleeping baby, we should not interrupt a playing baby too. Uninterrupted play can train their focus and sense of independence. Later, this is beneficial to build a good sleeping habit: soothing and get back to sleep on their own.

Papa's Read

Title: Common Sense on Mutual Fund

Author: John C. Bogle

Chapter read: Chapter 1 On Long Term Investing

Summary:

I would like just to make pointer on some important points from the book in this chapter.

- Long term gold investment return is very low compared with bond or stock

- Stock has a higher variance across years which mean more volatile, possibly higher return but also higher risk

- Bond has more stable variance, which mean lower return but moderate risk

- The best approach is to diversify the investment instrument

- Investing in long term shouldn't only take nominal return but also the actual return. Actual return is nominal return after adjusted with inflation rate

- The main takeaway from the chapter is, wise investor will invest in long term for better return using diversified instrument and not just speculating in short term